What Is a Bear Trap and How to Use It in Trading?

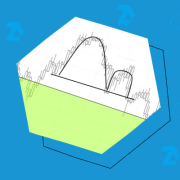

A bear trap is a market situation that can mislead inattentive traders. It consists of two movements: First, the asset price falls, creating the illusion of the beginning of a downtrend. Traders anticipating further decline rush to sell the asset, becoming bears. However, shortly after, the price begins to rise. This usually happens very rapidly, […]